The Role of Government in Shaping Personal Finance: Policies and Impacts

Introduction to Personal Finance and Government Role

Personal finance encompasses an individual’s decisions and strategies for managing income, expenses, savings, and investments over time. It is a journey of planning, budgeting, and investing to achieve financial security and meet life goals such as buying a home, funding education, or planning for retirement. While many aspects of personal finance are fundamentally personal, the role of government in shaping financial behaviors through policies and regulations is often indispensable.

Government interventions span across a wide range of areas including taxation, social security, regulation of financial institutions, and consumer protections. These interventions aim not only to safeguard economic stability but also to create a fair and equitable environment where individuals can thrive financially. By influencing the financial landscape, government policies can direct consumer behaviors, promote financial literacy, and provide safety nets during economic downturns.

Historically, government involvement in personal finance has evolved to meet the changing needs of society. From the introduction of income taxes to social security systems, these policies have significantly influenced personal financial management. Over time, governments have recognized the need to address economic disparities and ensure that all citizens have the opportunity to achieve financial stability.

In today’s complex financial landscape, the intersection between personal finance and governmental policies is more crucial than ever. With an increasing array of financial products available and a diverse economy, understanding the policy landscape can offer individuals a clearer path to making informed decisions. This article will delve into various facets of government policies, assessing their impacts on personal finance and exploring future trends.

Historical Context of Government Involvement in Personal Finance

The historical involvement of the government in personal finance can be traced back to various milestones that aimed at economic stability and social equity. Initially, government intervention was minimal, primarily focused on taxation, which significantly evolved over the centuries.

In the early 20th century, the introduction of the income tax system marked a crucial shift. The Revenue Act of 1913 in the United States introduced a federal income tax, initially targeting high-income earners. This was a significant step towards redistributing wealth and providing the government with resources to fund public services and infrastructure.

Another critical development was the introduction of social security systems during the Great Depression. In response to widespread economic hardship, the U.S. Social Security Act of 1935 was enacted, providing benefits to retirees and the unemployed, established social insurance programs that gave citizens financial support when they were most vulnerable. Similar systems were implemented worldwide, drastically altering personal finance management and long-term financial planning.

The post-World War II period saw further expansions in government roles, with the establishment of regulatory bodies such as the Securities and Exchange Commission (SEC) and Federal Deposit Insurance Corporation (FDIC) in the United States. These institutions were designed to ensure market stability and protect consumers, signaling a more proactive governmental approach in personal finance. The trend of increasing governmental involvement continued with policies aimed at consumer protection, economic stimulus, and financial literacy programs.

Taxation Policies and Their Impact on Personal Finances

Taxation remains one of the most direct ways governments impact personal finance. Income taxes, property taxes, and sales taxes are pivotal in how individuals manage their finances. These taxes provide the government with the necessary funds to sustain public infrastructure, social programs, and other essential services.

Types of Taxes and Their Effects

- Income Tax: Progressive income taxes mean that high earners pay a larger percentage of their income, which can influence savings and investment strategies.

- Property Tax: Geographically bound, property taxes affect homeowners and can be a significant determinant of where people choose to live.

- Sales Tax: Generally regressive, as everyone pays the same rate regardless of income, making consumer goods and services pricier and impacting spending habits.

Table: Types of Taxes and Their Impacts

| Type of Tax | Description | Impact on Personal Finance |

|---|---|---|

| Income Tax | Tax levied on individual earnings | Affects disposable income and can incentivize investments |

| Property Tax | Tax on real estate ownership | Influences homeownership decisions and geographic preferences |

| Sales Tax | Tax on goods and services purchased | Impacts consumer spending and can be regressive on lower incomes |

Government policies also include tax deductions, credits, and exemptions designed to incentivize certain behaviors, such as home ownership (mortgage interest deduction) and educational expense (education credits). These provisions often aim to encourage investments in key economic areas while providing relief to taxpayers.

Over the years, changes in taxation policies reflect the government’s response to economic conditions. Tax cuts or increases can stimulate or slow down economic activity, directly affecting employment, consumer behavior, and savings rates. Debates about the optimal tax structure persist, underscoring the balancing act between funding public services and fostering economic growth.

Government-Sponsored Retirement Plans and Benefits

Retirement planning is a crucial aspect of personal finance, with government-sponsored plans playing a foundational role in securing financial stability for individuals post-retirement. These plans aim to provide financial support to retirees who may no longer have income from employment.

Types of Government-Sponsored Plans

- Social Security: One of the most well-known programs, providing monthly benefits to retirees based on their earnings history.

- Public Pensions: Often for public sector workers, these defined-benefit plans offer guaranteed payments.

- Tax-Advantaged Accounts: Examples include IRAs and 401(k)s, which allow tax-deferred growth of retirement savings.

Table: Comparison of Retirement Plans

| Plan Type | Description | Eligibility | Benefits |

|---|---|---|---|

| Social Security | Monthly benefits | Workers with sufficient earnings history | Provides basic income |

| Public Pensions | Defined-benefit plans | Public sector employees | Guaranteed payment amounts |

| Tax-Advantaged A/C | Tax-deferred retirement accounts | Any individual who can contribute | Growth without immediate tax burden |

The government also provides regulatory oversight to ensure these plans are managed effectively and are sustainable long-term. For instance, the Employee Retirement Income Security Act (ERISA) in the US sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

Policies around retirement plans can significantly influence personal finance decisions, affecting how individuals save and invest. Given demographic shifts and increasing life expectancies, ensuring the sustainability and adequacy of these retirement funds remains a critical policy focus.

Regulations and Protections for Consumers in the Financial Market

Regulatory oversight is essential in maintaining trust and stability in financial markets. Governments globally have established regulations to protect consumers from fraudulent practices and financial mismanagement.

Key Consumer Protection Agencies

- Consumer Financial Protection Bureau (CFPB): Monitors financial products and services to ensure they are fair and transparent.

- Financial Conduct Authority (FCA): Regulates financial firms providing services to consumers and maintains the integrity of the financial markets in the UK.

- Securities and Exchange Commission (SEC): Protects investors and maintains fair and efficient markets in the US.

List of Common Financial Market Regulations

- Truth in Lending Act: Requires clear disclosure of key loan terms and costs.

- Fair Credit Reporting Act: Promotes accuracy, fairness, and privacy of information in consumer credit reports.

- Dodd-Frank Act: Offers comprehensive regulation to prevent systemic risks and protect consumer interests.

Table: Key Regulatory Agencies and Their Roles

| Agency | Region | Primary Functions |

|---|---|---|

| CFPB | United States | Monitors consumer financial products/services to ensure fairness |

| FCA | United Kingdom | Regulates financial services and maintains market integrity |

| SEC | United States | Protects investors and promotes market transparency |

These regulations not only aim to protect consumers but also to foster confidence in the financial system, which is crucial for economic stability. Ensuring ethical behavior and transparency in financial transactions helps in building a robust financial system where consumers can make informed decisions.

How Government Policies Affect Banking and Credit Systems

Banking and credit systems form the backbone of personal finance, providing the necessary support for economic activities ranging from daily transactions to large investments. Government policies here are vital in ensuring stability, efficiency, and fairness.

Key Government Policies in Banking Sector

- Monetary Policies: Central banks use tools such as interest rate adjustments and quantitative easing to influence economic activity.

- Banking Regulations: Requirements like the Dodd-Frank Act and Basel III aim to enhance the resilience of banks.

- Consumer Protection: Policies ensure transparent and fair access to banking services and credit.

Table: Government Impacts on Banking and Credit

| Policy Type | Description | Impact on Personal Finance |

|---|---|---|

| Monetary Policies | Interest rate adjustments, money supply control | Affects loan interest rates, saving interest rates, and investments |

| Banking Regulations | Financial strength requirements for banks | Ensures deposit safety and bank stability |

| Consumer Protection | Fair access to services and clear information | Empowers consumers with better financial choices |

Monetary policies particularly have immediate and tangible impacts on personal finance. For instance, a reduction in interest rates makes borrowing cheaper, encouraging spending and investment but potentially lowering savings rates. Conversely, higher interest rates can curb inflation but may deter borrowing and spending.

The regulation of banking institutions ensures that they are sufficiently capitalized and risk-averse, protecting consumers’ deposits and ensuring the availability of credit. Such regulations are crucial, especially in periods of financial instability, as they help prevent bank failures and ensure a consistent flow of credit in the economy.

The Role of Government in Promoting Financial Literacy

Financial literacy is the ability to understand and use various financial skills, including personal financial management, budgeting, and investing. Governments recognize the importance of financial literacy as a means to enhance economic stability and individual well-being.

Government Initiatives for Financial Literacy

- Educational Programs: Implementing school curricula that include financial education can lay early foundations for sound financial habits.

- Public Campaigns: Governments often run campaigns to raise awareness about important financial management topics such as savings, credit, and investment.

- Partnerships with NGOs: Collaborating with non-governmental organizations to leverage their expertise and reach in promoting financial literacy.

Table: Government Efforts in Financial Literacy

| Initiative Type | Description | Example Programs |

|---|---|---|

| Educational Programs | Integrating finance into school curricula | Financial Literacy and Education Commission (FLEC) in the US |

| Public Campaigns | Nationwide awareness campaigns | Money Smart Week by the Federal Reserve Bank |

| NGO Partnerships | Collaborating with NGOs for wider outreach | UK’s Money Advice Service (MAS) partnerships |

Effective financial literacy programs can significantly enhance individuals’ ability to make informed financial decisions. By understanding concepts such as interest rates, credit scores, and investment risks, consumers can better manage their personal finances, leading to improved financial health and reduced economic disparities.

Unemployment Benefits and Social Safety Nets

Government-established social safety nets and unemployment benefits are critical for providing financial stability and support during times of economic distress. Such programs are designed to offer temporary financial assistance to individuals who have lost their jobs through no fault of their own.

Types of Unemployment Benefits

- Unemployment Insurance: Provides financial assistance to eligible workers who are unemployed.

- Supplemental Nutritional Assistance Program (SNAP): Offers food purchasing assistance to low-income individuals and families.

- Temporary Assistance for Needy Families (TANF): Provides temporary financial assistance to families in need.

Table: Types of Social Safety Nets

| Program Name | Description | Eligibility Criteria |

|---|---|---|

| Unemployment Insurance | Provides financial assistance to unemployed workers | Must be unemployed and meet state eligibility requirements |

| SNAP | Offers food purchasing assistance | Based on income levels and household size |

| TANF | Temporary financial assistance for families | Low-income families with children or pregnant women |

These safety nets are essential not only for individual sustenance but also for maintaining economic stability. By providing financial aid, these programs help stabilize demand in the economy, mitigating the adverse effects of unemployment and economic downturns.

During periods of economic crisis like the COVID-19 pandemic, governments often expand these benefits to provide broader and more generous support. These expansions can include increased unemployment benefits and extended eligibility periods, which help support both the unemployed and the overall economy.

Government’s Influence on Housing and Mortgage Markets

Housing is a fundamental aspect of personal finance, influencing everything from savings to quality of life. Government policies heavily influence housing markets through regulation, subsidies, and intervention to ensure affordability and accessibility.

Key Government Policies in Housing

- Mortgage Interest Deduction: Allows homeowners to deduct mortgage interest on their taxes, encouraging homeownership.

- Subsidized Housing Programs: Programs like Section 8 provide assistance to low-income renters, making housing more affordable.

- Regulations and Oversight: Entities like the Federal Housing Administration (FHA) provide mortgage insurance, supporting lenders and borrowers.

Table: Government Tools in Housing Markets

| Policy or Program | Description | Impact on Housing Market |

|---|---|---|

| Mortgage Interest Deduction | Tax deduction on mortgage interest paid by homeowners | Encourages home-buying and ownership |

| Subsidized Housing Programs | Financial assistance for low-income renters | Increases access to affordable housing |

| FHA Mortgage Insurance | Provides insurance on loans made by FHA-approved lenders | Supports risk reduction for lenders, enhances credit availability |

Policies such as the mortgage interest deduction have been highly influential in driving homeownership rates. By reducing the cost of home ownership, these policies can make buying a home more accessible for many people.

On the other end, subsidized housing helps ensure that low-income families have access to safe and affordable housing, which is fundamental to financial stability and well-being. Proper regulation and oversight of the housing market also help prevent malpractices and ensure that housing finance systems remain robust.

Future Trends and Potential Government Actions

As we look towards the future, potential government actions will continue to shape personal finance landscapes amid evolving economic conditions and societal changes. Several trends and potential actions stand out as particularly influential.

Emerging Trends

- Sustainable Finance: Governments are increasingly focusing on promoting environmentally and socially responsible investments.

- Digitalization of Financial Services: There’s a growing trend towards digital banking, fintech solutions, and blockchain technology regulation.

- Universal Basic Income (UBI): Discussions around UBI are gaining traction as a means to provide financial security in an automated economy.

Table: Future Government Actions

| Action Type | Description | Potential Impact on Personal Finance |

|---|---|---|

| Sustainable Finance Policies | Incentivizing investments in green and ethical assets | Promotes environmentally responsible investment and sustainable growth |

| Digital Finance Regulation | Regulating fintech and digital currencies | Ensures consumer protection and financial stability in a digital economy |

| Universal Basic Income | Directly providing regular income to citizens | Provides financial security and reduces economic inequality |

The move towards sustainable finance highlights the growing recognition of the importance of environmentally responsible investing. Governments may introduce policies to incentivize such investments, shaping the way individuals and institutions allocate their capital.

The digitalization of financial services is another key trend, with fintech innovations transforming how people interact with their finances. Government regulations will need to adapt to ensure these innovations are accessible, safe, and beneficial for consumers.

The concept of Universal Basic Income, while not yet widespread, is being discussed as a potential tool to mitigate economic inequalities and provide a safety net in a world where automation may reduce traditional employment opportunities. If implemented, UBI could profoundly impact how individuals approach work, savings, and investments.

Conclusion: Balancing Acts and Future Challenges

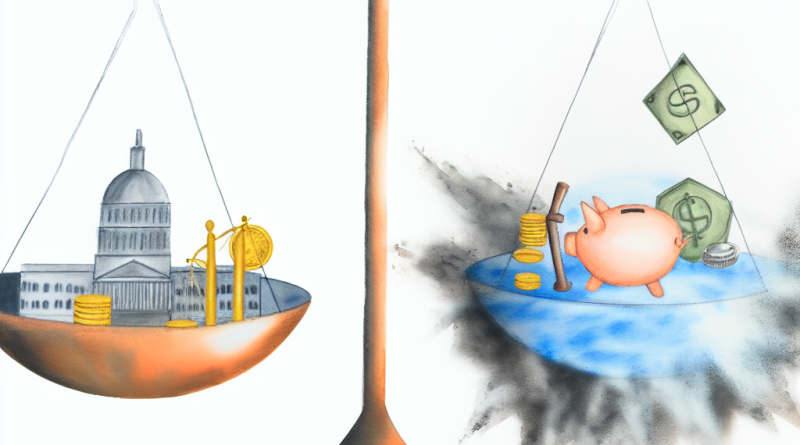

In conclusion, the role of government in shaping personal finance is multifaceted and ever-evolving. Through policies related to taxation, retirement planning, consumer protection, and economic stability, governments exert significant influence over individual financial behaviors and overall economic health.

Balancing these policies to ensure they promote fairness, economic growth, and sustainability is a continual challenge. Governments must navigate complex socio-economic landscapes, responding to immediate concerns such as economic crises while also planning for long-term stability.

Future challenges will likely include adapting to technological advancements, addressing environmental concerns through sustainable finance, and exploring concepts like Universal Basic Income to enhance social equity. The efficacy of these approaches will depend on careful planning, inclusive policies, and continuous adaptation to new economic realities.

Ultimately, governments play a crucial role in creating a financial environment where individuals can achieve security and prosperity. Their actions and policies will continue to shape the personal finance landscape, necessitating ongoing dialogue and collaboration between policymakers, financial institutions, and the public.

Recap

- Historical Context: Government involvement has evolved from basic taxation to comprehensive social security systems and financial regulations.

- Taxation Policies: Different tax types like income, property, and sales taxes directly impact personal finances.

- Retirement Plans: Social Security, public pensions, and tax-advantaged accounts are crucial for financial stability post-retirement.

- Consumer Protections: Regulatory bodies ensure transparency and fairness in financial markets.

- Banking System: Policies influence interest rates, banking regulations, and consumer protections.

- Financial Literacy: Government initiatives aim to educate the public on financial management skills.

- Social Safety Nets: Programs like unemployment insurance and TANF provide crucial support during economic hardship.

- Housing Market: Policies and programs help make housing affordable and accessible.

- Future Trends: Emerging trends include sustainable finance, digital finance regulation, and discussions around Universal Basic Income.

FAQ

-

How do government policies influence personal finance?

Government policies influence personal finance through taxation, regulation of financial markets, retirement planning, and social safety nets. -

What are the main types of taxes and their impacts?

Main types include income tax, property tax, and sales tax. They affect disposable income, homeownership decisions, and consumer spending. -

What role do government-sponsored retirement plans play?

They provide financial support post-retirement and include programs like Social Security and public pensions. -

How do regulations protect consumers in the financial market?

Regulations ensure fairness, transparency, and prevent fraudulent practices, fostering trust in financial systems. -

How do monetary policies affect personal finance?

Monetary policies influence interest rates, affecting borrowing costs, savings rates, and investments. -

What initiatives promote financial literacy?

Educational programs, public awareness campaigns, and partnerships with NGOs are key government initiatives promoting financial literacy. -

How do unemployment benefits help during economic distress?

These benefits provide financial support to unemployed individuals, helping them maintain their financial stability. -

What potential future actions could governments take in personal finance?

Potential future actions include promoting sustainable finance, regulating digital financial services, and considering Universal Basic Income.

References

- U.S. Department of the Treasury. “History of the U.S. Tax System.” Treasury.gov.

- Social Security Administration. “Understanding the Benefits.” SSA.gov.

- Consumer Financial Protection Bureau. “About Us.” ConsumerFinance.gov.