How to Balance Mental Health and Financial Well-being: A Comprehensive Guide

Introduction: The Interrelationship Between Mental Health and Financial Well-being

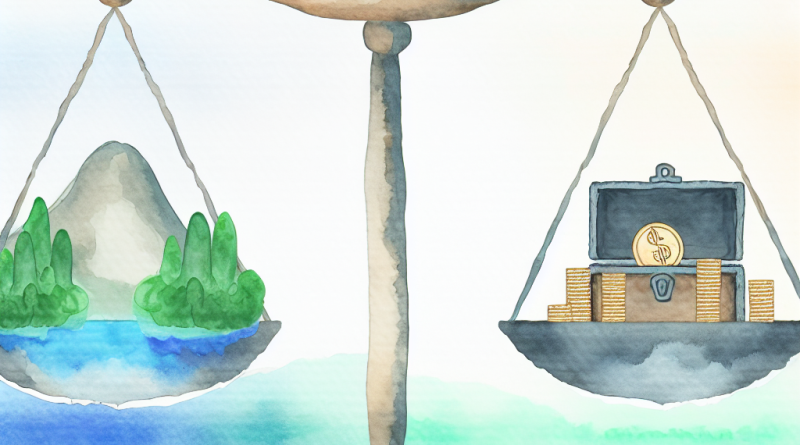

Balancing mental health and financial well-being is a crucial yet often overlooked aspect of overall wellness. These two facets of our lives are deeply intertwined, influencing each other in myriad ways. Financial stability can alleviate stress and contribute to mental wellness, while mental health issues can complicate financial decision-making. Understanding this relationship is the first step towards achieving holistic well-being.

Financial stress is a common yet insidious influencer of mental health. High levels of debt, insufficient income, or the lack of a financial safety net can lead to anxiety and depression. This emotional burden can, in turn, impair one’s ability to manage finances efficiently, creating a vicious cycle that’s hard to break. As the pressure mounts, mental health deteriorates, affecting productivity and interpersonal relationships.

In contrast, sound financial practices can foster a sense of control and peace of mind. Establishing a budget, building an emergency fund, and seeking professional advice are practical steps that offer both financial stability and mental relief. When individuals feel secure about their financial situation, they are better equipped to handle life’s uncertainties, reducing stress and promoting mental wellness.

This comprehensive guide aims to explore the intricate balance between mental health and financial well-being. From recognizing the signs of financial stress affecting your mental health to implementing strategies for managing both, the following sections will provide actionable insights. Whether you’re dealing with financial difficulties or seeking ways to maintain mental wellness, this guide offers a roadmap for achieving a balanced life.

Understanding the Impact of Financial Stress on Mental Health

Financial stress is a significant factor affecting mental health, manifesting in various forms such as anxiety, depression, and even physical ailments. Understanding this impact is crucial for both personal well-being and societal health at large.

Firstly, financial stress can lead to severe anxiety. Worrying about unpaid bills, looming debts, or an unstable income can keep you up at night, affecting your sleep quality and overall mental well-being. This anxiety often results in a decreased ability to concentrate, making it challenging to perform well at work or engage fully in personal relationships.

Secondly, chronic financial strain can trigger depression. The feeling of being trapped in a precarious financial situation can lead to hopelessness and a lack of motivation. Depression can further exacerbate financial problems, as it often results in decreased productivity and poor decision-making. The cycle of financial trouble and mental health deterioration becomes increasingly difficult to break.

Lastly, the physiological impact of financial stress cannot be ignored. Chronic stress increases the risk of various health issues, including heart disease, high blood pressure, and a weakened immune system. These health problems add another layer of stress, creating a complicated web of challenges that affect every aspect of life.

Signs That Financial Issues Are Affecting Your Mental Well-being

Recognizing the signs that financial issues are affecting your mental well-being is the first step towards addressing the problem. These signs can be subtle or glaring, but acknowledging them is essential for taking action.

One of the most common signs is a constant feeling of anxiety or worry about your financial situation. This can manifest as frequent thoughts about unpaid bills, fear of losing your job, or incessant calculations about your budget. If you find yourself ruminating over these issues, it’s a clear indication that financial stress is impacting your mental health.

Another sign is irritability or mood swings. Financial problems can take an emotional toll, affecting your mood and behavior. You may find yourself snapping at loved ones or feeling uncharacteristically angry or frustrated. These emotional fluctuations can strain your relationships, further increasing your stress levels.

Physical symptoms like headaches, gastrointestinal issues, or persistent fatigue can also indicate that financial stress is affecting your mental well-being. Stress can weaken the immune system and exacerbate pre-existing health conditions, making you more susceptible to illness. If you’re experiencing unexplained physical symptoms, it may be worth examining your financial stress levels.

Strategies for Managing Financial Stress

Managing financial stress effectively requires a multifaceted approach that addresses both the practical and emotional aspects of financial well-being. Here are some strategies to help you regain control and reduce stress.

Firstly, educate yourself about personal finance. Understanding the basics of budgeting, saving, and investing can empower you to make informed decisions. Knowledge is a powerful antidote to stress. Numerous free and low-cost resources, from online courses to community workshops, can help improve your financial literacy.

Secondly, adopt stress-management techniques to cope with immediate anxiety. Practices like deep breathing, meditation, or physical exercise can provide temporary relief and improve your mental resilience. Incorporating these activities into your daily routine can help you manage stress more effectively over the long term.

Lastly, seek support when needed. Talking to a trusted friend or family member about your financial worries can provide emotional relief and new perspectives. Professional help from financial advisors or mental health counselors can also offer targeted strategies to manage your situation better.

Creating a Budget to Ease Financial Anxiety

Creating a budget is a foundational step in reducing financial anxiety. A well-structured budget provides a clear picture of your income, expenses, and financial goals, offering peace of mind and a sense of control.

To start, list all your sources of income and categorize your expenses. Essentials like rent, utilities, and groceries should be prioritized, followed by discretionary spending like dining out or entertainment. This exercise will help you identify where your money is going and where you can cut back if necessary.

Next, set realistic financial goals. Whether you’re saving for a vacation, paying off debt, or building an emergency fund, having specific goals can make your budgeting efforts more focused and rewarding. Break these goals into manageable steps to stay motivated and track your progress.

Finally, review and adjust your budget regularly. Life is dynamic, and your financial needs and goals may change over time. Regularly updating your budget allows you to adapt to new circumstances, ensuring that your financial plan remains relevant and effective.

| Income | Monthly Amount |

|---|---|

| Salary | $4,000 |

| Freelance Work | $500 |

| Other Income | $200 |

| Expenses | Monthly Amount |

|---|---|

| Rent | $1,200 |

| Utilities | $300 |

| Groceries | $400 |

| Transportation | $150 |

| Entertainment | $200 |

Building an Emergency Fund for Peace of Mind

An emergency fund is one of the most effective tools for achieving financial stability and mental wellness. It acts as a financial cushion, providing peace of mind by preparing you for unexpected expenses.

Firstly, determine the amount you need in your emergency fund. Financial experts generally recommend saving three to six months’ worth of living expenses. This amount ensures that you can cover essential costs like rent, utilities, and groceries in case of job loss, medical emergencies, or other unforeseen events.

Secondly, automate your savings to build your emergency fund effortlessly. Set up automatic transfers from your checking account to a high-yield savings account dedicated to your emergency fund. Automation ensures consistency and helps you reach your savings goals faster.

Lastly, use your emergency fund wisely. Only tap into it for genuine emergencies, and make it a priority to replenish the fund as soon as possible after using it. Keeping your emergency fund intact provides ongoing financial security and reduces long-term stress.

Seeking Professional Help for Mental Health Issues

When financial stress becomes overwhelming, seeking professional help for mental health issues can be a crucial step towards recovery. Professional guidance offers tailored strategies to manage both mental and financial health effectively.

Therapists and counselors specializing in financial stress can help you develop coping mechanisms and improve your overall mental wellness. Cognitive-behavioral therapy (CBT) is particularly effective in treating anxiety and depression related to financial issues. CBT helps you identify and change negative thought patterns, making it easier to handle financial stress.

Financial advisors can provide expert advice on managing your finances, offering personalized plans to improve your financial stability. Combining financial and mental health expertise can offer a holistic approach to tackling financial stress, ensuring that both aspects are addressed comprehensively.

Don’t hesitate to seek help early. Addressing mental health issues sooner rather than later can prevent them from escalating and complicating your financial situation further. Early intervention offers the best chance for a swift and effective recovery.

Effective Ways to Discuss Financial Concerns with Loved Ones

Discussing financial concerns with loved ones can be challenging but is essential for maintaining both financial stability and relationship health. Open communication helps ensure that everyone is on the same page and can work together towards common financial goals.

First, choose the right time and setting for the conversation. Financial discussions can be emotionally charged, so it’s essential to talk when everyone is calm and not preoccupied with other concerns. A relaxed, private setting can make the conversation more comfortable and productive.

Next, be transparent about your financial situation. Honesty fosters trust and understanding, making it easier to discuss sensitive topics like debt or budgeting. Share your financial goals and challenges openly, and encourage your loved ones to do the same.

Lastly, collaborate on solutions. Financial planning should be a joint effort, particularly in families or partnerships. Develop a budget together, set joint financial goals, and establish a system for regular financial check-ins. Working as a team can strengthen relationships and contribute to shared financial well-being.

Developing Healthy Financial Habits for Long-term Mental Wellness

Developing healthy financial habits is crucial for achieving long-term mental wellness. Good financial practices reduce stress, improve financial stability, and contribute to overall well-being.

One essential habit is regular budgeting. Consistently tracking your income and expenses helps you stay in control of your finances and anticipate potential shortfalls. A detailed budget allows you to allocate funds effectively, reducing the likelihood of financial stress.

Another important habit is mindful spending. Evaluate your purchases critically, distinguishing between needs and wants. Mindful spending helps you prioritize essential expenses and prevent unnecessary debt, contributing to financial stability and mental peace.

Finally, focus on long-term financial planning. Goals like retirement savings, buying a home, or paying off a mortgage require long-term strategies. Investing in retirement accounts, creating a savings plan, and seeking professional financial advice can help you achieve these goals, ensuring long-term financial and mental well-being.

The Role of Mindfulness and Relaxation Techniques in Financial Stress Management

Mindfulness and relaxation techniques play a crucial role in managing financial stress. These practices help you stay present, reduce anxiety, and improve overall mental wellness.

Mindfulness involves paying attention to the present moment without judgment. Techniques like deep breathing, meditation, and mindful walking can help reduce financial stress by interrupting negative thought patterns. Practicing mindfulness regularly enhances your mental resilience, making it easier to handle financial worries.

Relaxation techniques, such as progressive muscle relaxation or guided imagery, can also alleviate financial stress. These methods help you relax physically and mentally, lowering stress hormones and promoting a sense of well-being. Incorporating these techniques into your routine can improve your ability to manage financial stress.

Additionally, combining mindfulness and relaxation practices with financial planning creates a balanced approach to managing financial stress. Relaxation techniques offer immediate relief, while mindful financial planning provides long-term solutions, contributing to overall mental wellness.

Resources and Support Networks for Financial and Mental Health Assistance

Various resources and support networks can assist you in managing financial and mental health challenges. Utilizing these resources can provide valuable guidance and support.

Firstly, consider financial counseling services. Organizations like the National Foundation for Credit Counseling (NFCC) offer professional advice on budgeting, debt management, and financial planning. These services can help you develop a practical plan to improve your financial situation.

Secondly, seek mental health support. Therapy and counseling services are available through local health departments, community centers, and online platforms like BetterHelp and Talkspace. These services provide professional mental health support, helping you cope with financial stress and improve overall wellness.

Lastly, join support groups. Communities focused on financial and mental health issues offer mutual support and shared experiences. Groups like Debtors Anonymous or local mental health organizations provide a sense of community and practical advice, helping you navigate financial and mental health challenges more effectively.

Conclusion

Balancing mental health and financial well-being is a multifaceted endeavor that requires attention, effort, and a holistic approach. The intricate relationship between financial stability and mental health highlights the need for proactive measures and self-awareness. As demonstrated in this comprehensive guide, numerous strategies can be employed to manage financial stress, maintain mental wellness, and achieve overall well-being.

Addressing financial stress is critical in preventing its negative impact on mental health. Recognizing the signs, seeking professional help, and using targeted strategies can mitigate the adverse effects of financial strain. By understanding the root causes and taking effective action, individuals can regain control and improve their mental and financial health.

Developing healthy financial habits and incorporating mindfulness and relaxation techniques can further enhance mental wellness. These practices provide both short-term relief and long-term stability, fostering a sense of control and peace of mind. Being mindful of spending and engaging in regular financial planning are key steps towards achieving a balanced life.

Ultimately, utilizing available resources and support networks can offer valuable assistance. Whether through financial counseling, mental health therapy, or support groups, seeking help is a proactive step towards better managing both financial and mental health challenges. Embracing these strategies and resources paves the way for a more balanced and fulfilling life.

Recap

- Financial stress significantly affects mental health, leading to anxiety, depression, and physical ailments.

- Signs of financial stress include constant worry, irritability, and physical symptoms like headaches.

- Effective strategies for managing financial stress include educating yourself, adopting stress-management techniques, and seeking support.

- Creating a budget helps ease financial anxiety by providing a clear picture of your finances.

- Building an emergency fund offers financial security and peace of mind.

- Seeking professional help for mental health issues can provide tailored strategies for recovery.

- Discussing financial concerns with loved ones fosters understanding and collaborative solutions.

- Developing healthy financial habits ensures long-term mental wellness.

- Mindfulness and relaxation techniques are crucial for managing financial stress.

- Various resources and support networks are available for financial and mental health assistance.

FAQ

Q1: How does financial stress affect mental health?

A1: Financial stress can lead to anxiety, depression, and physical ailments, affecting overall mental well-being.

Q2: What are common signs that financial issues are affecting my mental health?

A2: Signs include constant worry, irritability, mood swings, and physical symptoms like headaches or fatigue.

Q3: How can I manage financial stress effectively?

A3: Strategies include educating yourself about personal finance, adopting stress-management techniques, and seeking support from trusted individuals or professionals.

Q4: How do I create a budget to reduce financial anxiety?

A4: List all your sources of income and expenses, set realistic financial goals, and regularly review and adjust your budget.

Q5: Why is an emergency fund important for mental wellness?

A5: An emergency fund provides financial security, preparing you for unexpected expenses and reducing long-term stress.

Q6: When should I seek professional help for financial-related mental health issues?

A6: Seek help early if financial stress becomes overwhelming, causing significant anxiety, depression, or physical symptoms.

Q7: How can I discuss financial concerns with loved ones?

A7: Choose the right time and setting, be transparent about your situation, and collaborate on solutions to maintain both financial stability and relationship health.

Q8: What resources and support networks are available for managing financial and mental health?

A8: Financial counseling services, mental health therapy platforms, and support groups like Debtors Anonymous offer valuable guidance and community support.

References

- “Mental Health and Money Advice.” Mental Health and Money, www.mentalhealthandmoneyadvice.org.

- “Financial Stress and Your Health.” American Psychological Association, www.apa.org/news/press/releases/stress/2020/sia-2020.pdf.

- “Building an Emergency Fund.” NerdWallet, www.nerdwallet.com/article/banking/build-emergency-fund.