Effective Strategies on Balancing Saving Money and Enjoying Life in the Present

Introduction to the Importance of Financial Balance

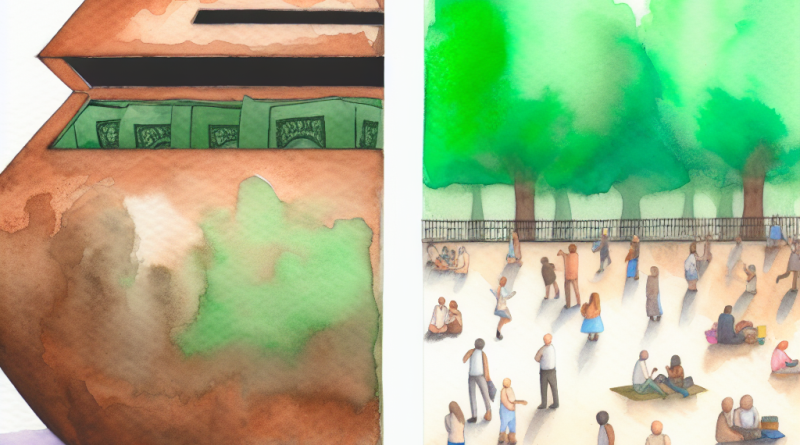

In today’s fast-paced world, finding a balance between saving for the future and enjoying life in the present can often seem elusive. Many people struggle to maintain this equilibrium, leading to stress and dissatisfaction. Financial balance is an essential component of overall well-being, as it allows individuals to prepare for unforeseen circumstances while ensuring they don’t miss out on life’s joys. By carefully managing your finances, you can cultivate a lifestyle that satisfies both immediate desires and long-term security.

Today’s economic climate necessitates prudence and planning more than ever. The rising cost of living, coupled with the unpredictable nature of employment, makes it critical to strike the right balance between spending and saving. While it might be tempting to focus heavily on either saving or spending, being too extreme in either direction can have dire consequences. Consequently, understanding how to appropriately manage your finances is crucial for achieving peace of mind and contentment.

Irrespective of your income level, the principles of financial management remain the same: earn, save, invest, and spend wisely. But the emphasis you place on each can make all the difference in reaching financial stability and satisfaction. Developing a healthy relationship with money is not solely about accumulating wealth; it is about leveraging your resources to enhance quality of life without compromising future needs.

In short, the goal of balancing saving and spending is to ensure a sense of financial security while also living a fulfilling life. The pursuit of this balance requires strategic planning, self-discipline, and sometimes, a reevaluation of your priorities and habits. As we explore effective strategies for achieving this harmony, remember that personal finance is just that—personal. What works for one person might not suit another, so tailor these tips to your individual needs.

Understanding the Consequences of Over-saving or Overspending

Striking a balance between saving and spending requires understanding the potential drawbacks of tipping the scales too far in either direction. Over-saving, while seemingly responsible, can lead to an overly frugal lifestyle that deprives you of life’s pleasures. In extreme cases, this behavior—often driven by fear or insecurity—can prevent individuals from enjoying meaningful experiences that enrich their lives.

Conversely, overspending can lead to debt, financial anxiety, and a lack of preparedness for future needs. Those who prioritize immediate gratification over future security might indulge in impulsive purchases that offer temporary satisfaction but long-term regret. Overspending often results in living paycheck to paycheck, with little room for unexpected expenses or emergencies, creating a fragile financial foundation.

Finding the middle ground is essential to avoid these pitfalls. It involves creating a dynamic approach to personal finance that accommodates both current enjoyment and future security. This balanced strategy ensures that your lifestyle does not get sacrificed for savings goals and vice versa. Achieving this requires conscious decision-making and often, a shift in mindset from focusing on singular financial objectives to a more holistic view of money management.

Assessing Your Current Financial Situation

Before you can effectively balance saving and spending, you must assess your current financial situation. This involves taking a close look at your income, expenses, debts, and assets to gain a comprehensive understanding of your financial health. Begin by gathering all financial records, including bank statements, credit card bills, and loan documents. This will help you identify patterns and problem areas that need addressing.

Creating a detailed list or spreadsheet to organize this information can provide clarity. Note your fixed monthly expenses (e.g., rent, utilities) and variable expenses (e.g., dining out, entertainment). Identifying these will show where your money is going and how much is left at the end of each month for savings or discretionary spending.

It’s crucial to recognize areas where spending can be reduced without sacrificing quality of life. This doesn’t mean cutting out all ‘unnecessary’ spending but rather making room for priorities that align with your values and goals. Reassessing your subscriptions, memberships, and other routine expenses can free up funds for both saving and life-enriching activities.

| Category | Monthly Expense | Potential Savings |

|---|---|---|

| Housing | $1,200 | $0 |

| Utilities | $300 | $50 |

| Food | $400 | $100 |

| Transportation | $150 | $30 |

| Entertainment | $200 | $50 |

Setting Clear Financial Goals for Saving and Enjoyment

Establishing financial goals is a pivotal step in achieving a balance between saving and enjoying life. Clear goals serve as a roadmap, guiding your spending decisions and saving habits. These goals should encompass both short-term objectives, like a holiday or a big purchase, and long-term aspirations, such as retirement or buying a home.

To set effective financial goals, employ the SMART criteria—they should be Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, a goal might be to save $5,000 over the next twelve months for an overseas trip. Having detailed parameters makes it easier to track progress and adjust planning as necessary.

Moreover, effective goal-setting involves categorizing goals into needs and wants. Needs are essentials that contribute to financial security, such as an emergency fund or retirement savings, while wants are the experiences or items that enhance your present life. Balancing these ensures that while you’re prepared for the future, you’re also enjoying the journey there.

Creating a Realistic Budget for Daily Expenses and Leisure Activities

Crafting a realistic budget is crucial for managing your finances effectively. A well-planned budget helps allocate resources for essential expenses while leaving room for leisure activities that enhance your quality of life. Start by identifying your monthly income and then prioritizing expenses based on necessity and importance.

Allocate funds first to essentials like bills, groceries, and transportation. Once these are covered, determine how much you can comfortably afford to set aside for savings and discretionary spending. An effective budgeting technique is the 50/30/20 rule: 50% of income for needs, 30% for wants, and 20% for savings. This framework ensures that all critical areas are addressed without sacrificing enjoyment.

While creating your budget, include a category for leisure and entertainment. This proactive approach allows you to indulge in activities that bring joy, such as dining out, hobbies, or small trips, without negatively impacting your savings. Regularly review and adjust your budget as income or expenses change to maintain financial harmony.

Incorporating Savings into Your Monthly Budget

Incorporating savings into your monthly budget is a non-negotiable part of effective financial management. Savings should be treated as a fixed expense—in other words, pay yourself first. By prioritizing savings, you establish a financial cushion that can protect you during emergencies and facilitate future investment opportunities.

Automate your savings as much as possible. Set up automatic transfers from your checking account to a savings account to ensure consistency and reduce the temptation to spend those funds. The amount saved should be realistic yet challenging, based on your income and expenses.

Consider creating multiple savings categories, such as an emergency fund, retirement savings, and a fun fund for small indulgences. Breaking down savings goals can make the process feel more tangible and less overwhelming, providing motivation and satisfaction as each fund grows.

Tips for Enjoying Life Without Burdening Finances

Enjoying life without burdening your finances requires creativity and mindfulness. It’s important to recognize that enjoyment does not always equate to spending money. Exploring cost-effective ways to have fun can enrich your life without depleting your resources.

- Explore Free or Low-cost Activities: Local events, galleries, parks, and community festivals often provide entertainment at little or no cost.

- Embrace DIY Projects: Learn new skills like cooking, crafting, or gardening, which can be fulfilling and cost-saving.

- Take Advantage of Discounts and Loyalty Programs: Use coupons and sign up for loyalty programs to reduce expenses on daily purchases and leisure activities.

Deliberately choose activities that align with your values and passions. Sometimes the most meaningful experiences are those that foster personal growth rather than material accumulation. Aim for experiences that create lasting memories and fulfill deeper desires, enhancing your overall well-being.

Mindful Spending: Making Thoughtful Purchases

Mindful spending is about making thoughtful decisions that reflect your values and priorities. This approach promotes financial well-being by encouraging you to question each purchase’s necessity and its impact on your overall financial plan.

Start by evaluating your spending motives; ask yourself if a purchase is truly necessary or merely impulse-driven. Wait 24 hours before making significant purchases to determine if it’s something you genuinely need or want. This delay often distinguishes between impulse buys and meaningful investments.

Additionally, prioritize quality over quantity. Investing in durable, high-quality items can be more cost-effective long term, reducing the frequency of replacements and minimizing waste. Embrace a minimalist mindset by focusing on possessions that bring value and joy to your life without cluttering your space and finances.

The Role of Technology in Tracking and Controlling Budget

Technology plays a pivotal role in maintaining financial discipline and ensuring effective budget management. Various financial tools and apps are designed to track spending, monitor savings, and offer insights into personal finance habits.

- Budgeting Apps: Applications like Mint, YNAB (You Need A Budget), and PocketGuard categorize expenses and provide real-time updates on spending habits, aiding informed decisions.

- Spending Trackers: Tools that connect to your bank accounts can offer insights into spending patterns and pinpoint areas where you might cut back.

- Investment Platforms: Apps like Acorns or Robinhood simplify investment processes, enabling accessible growth of savings.

These technologies can automate and simplify financial management tasks, reducing the effort required to maintain a balanced financial plan. They provide transparency, making it easier to track goals and adjust strategies as necessary, thus fostering a better understanding of personal finance.

Regularly Reviewing and Adjusting Your Financial Plan

Financial planning is not a one-time event but an ongoing process. Regularly revisiting and adjusting your financial plan is crucial to ensure it continues to meet your needs and adapt to changes in your life situation. Schedule periodic reviews—quarterly or bi-annually—to assess progress towards your financial goals and make adjustments where needed.

During these reviews, update your budget to reflect changes in income, expenses, and priorities. Perhaps you’ve achieved some goals and need to establish new ones, or maybe unexpected expenses have arisen. Being flexible and responsive to these changes ensures that your financial plan remains relevant and effective.

Additionally, involve a partner or trusted advisor in these reviews for an external perspective that can reveal blind spots or offer new strategies. Regularly updating your financial plan not only keeps you on track but also empowers you with knowledge and confidence to make sound financial decisions.

Conclusion: Achieving a Sustainable Balance Between Saving and Enjoyment

Achieving a sustainable balance between saving and spending is an ongoing journey that involves thoughtful planning and self-awareness. This balance empowers you to live a life that’s both financially responsible and fulfilling. It’s about finding harmony between preparing for the future and enjoying the present, enabling you to derive value and joy from both.

Financial balance requires the development of effective habits and strategies that align with your personal goals and circumstances. Through ongoing assessment and adaptation of your financial plan, you can create a lifestyle that fosters peace of mind and enriches your daily life.

Ultimately, achieving this equilibrium boosts your confidence in handling financial matters, promoting a sense of freedom and security that permeates all aspects of life. Remember, the best financial plan is one that enhances your overall well-being—allowing you to live intentionally and purposefully, both today and tomorrow.

Recap

- Financial balance is essential for life satisfaction and security.

- Over-saving or overspending can lead to undesirable consequences.

- Regular assessment of finances is vital to tailoring a balanced approach.

- Clear goals and a realistic budget align spending with values.

- Mindful spending enhances quality of life without financial stress.

- Technology is a valuable tool for tracking and refining financial plans.

- Regular financial reviews foster adaptability and sustained balance.

FAQ

-

What is financial balance?

Financial balance refers to managing your income in a way that enables you to save for future needs while also enjoying your present life. -

Why is it important to balance saving and spending?

Balancing saving and spending prevents financial stress and ensures you’re prepared for the future while enjoying meaningful experiences now. -

How can I start to assess my financial situation?

Collect and organize financial documents like bank statements and bills to identify spending patterns and potential areas for adjustment. -

What are some strategies for setting financial goals?

Use the SMART criteria and categorize goals into needs and wants to establish a clear roadmap for saving and spending. -

How does mindful spending improve finances?

Mindful spending ensures that purchases reflect your priorities, helping prevent unnecessary expenditures and supporting financial goals. -

What technology tools can aid financial management?

Budgeting apps and spending trackers automate management tasks, providing insights and simplifying the budgeting process. -

How often should I review my financial plan?

Review your financial plan quarterly or bi-annually to ensure it continues to align with your goals and adapt to any changes in circumstances. -

Why is incorporating savings into a budget crucial?

Treating savings as a non-negotiable expense ensures consistent contributions towards financial security and helps avoid impulse spending.

References

- Ramit Sethi, “I Will Teach You to Be Rich”, Workman Publishing, 2019.

- Vicki Robin, “Your Money or Your Life”, Penguin Books, 2018.

- Dave Ramsey, “The Total Money Makeover”, Thomas Nelson, 2013.