The Real Effects of Inflation on Your Budget and How to Adapt

Inflation is a term that often brings a frown to many faces, and rightfully so. It represents the decline of purchasing power of a given currency over time, a phenomenon that can have widespread implications on both the macroeconomic scale and the day-to-day budget of individuals. Understanding inflation is crucial for anyone trying to navigate the complexities of financial planning and personal budgeting. As prices rise, the same amount of money buys less, which can lead to significant challenges in maintaining one’s standard of living. This article aims to dissect the real effects of inflation on your budget and offer insightful strategies for adapting to and mitigating these impacts.

The importance of grasping the concept of inflation lies not only in its economic textbook definition but in its tangible effects on your household budget. Day-to-day expenses, savings, and even your long-term financial goals can be severely disrupted by unchecked inflation. Recognizing the signs and planning accordingly can mean the difference between financial security and instability.

As inflation remains a persistent part of economic cycles, individuals are increasingly required to adapt their financial strategies to cope. This involves not only adjusting day-to-day spending but also adopting a more nuanced approach to savings, investments, and overall financial planning. In the wake of these challenges, the objective becomes twofold: protect your current standard of living and ensure that your long-term financial health remains on solid ground.

Equipped with the right knowledge and strategies, it’s possible to navigate the murky waters of inflationary pressure. From understanding the direct impact on your household budget to exploring the connection between inflation and interest rates, this article will provide a comprehensive guide for adapting your financial practices in response to inflation. Implementing practical budgeting tips, investing wisely, and planning for the long term are all crucial steps in staying financially resilient in an inflationary world.

What is Inflation and Why Does It Matter to You?

Inflation represents the rate at which the general level of prices for goods and services is rising, subsequently eroding purchasing power. It’s an essential economic indicator because it gives us an insight into the state of an economy and guides policymakers in their decision-making processes. For individuals, the implications of inflation are direct and personal: it dictates how much your dollar will be worth tomorrow and, by extension, how much you can afford.

- Inflation’s immediate impact is felt in the rising cost of living. As prices increase, every dollar you earn buys a smaller percentage of a good or service.

- This effect is particularly challenging for fixed-income earners, retirees, and savers, whose income does not increase at the pace of inflation.

- Inflation also matters because it influences decisions on savings, investments, and loans, affecting your financial planning and future purchasing power.

The Direct Effects of Inflation on Your Household Budget

The relationship between inflation and household budgeting is inseparable. Inflation reduces the value of money, which means your budget can start to feel tighter without any changes in spending habits. Here’s how inflation directly affects your household budget:

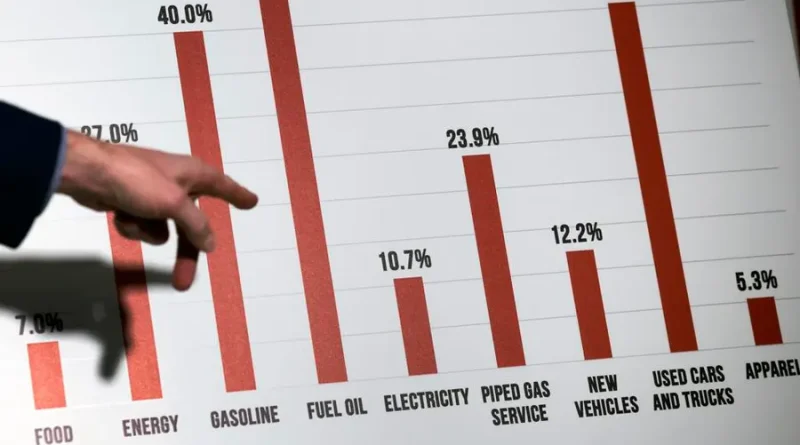

- Rising Daily Expenses: From groceries to gas, the cost of daily essentials can increase, leaving less room in your budget for discretionary spending.

- Decreased Savings Capability: As more money is channeled towards coping with rising expenses, the ability to save diminishes.

- Delayed Goals: Major financial goals, such as buying a home or retirement, can become more challenging to achieve due to the eroded purchasing power.

Analyzing the Link Between Inflation and Interest Rates

The link between inflation and interest rates is critical in understanding how your savings and loans are affected by economic changes.

- Interest Rates as a Monetary Policy Tool: Central banks manipulate interest rates to control inflation. Higher rates can slow economic growth, cooling inflation, while lower rates can spur growth and potentially increase inflation.

- Impact on Savings: High inflation often leads to higher interest rates, which can benefit savers if their savings rate outpaces inflation. However, this is often not the case in real terms.

- Effect on Loans: For borrowers, high inflation can lead to higher interest rates on loans, making mortgages and other loans more expensive.

Practical Budgeting Tips to Counter the Impact of Inflation

To combat the erosion of your purchasing power due to inflation, consider implementing these practical budgeting tips:

- Track Your Spending: Being aware of where your money goes is the first step in identifying areas where adjustments can be made.

- Prioritize Needs Over Wants: Focus on spending on essentials and delay purchases that can wait.

- Shop Smart: Look for deals, use coupons, and consider buying in bulk to save money on everyday expenses.

Investing Wisely to Outpace Inflation

Investing is one of the most effective ways to outpace inflation. Here are a few tips to consider:

- Diverse Investment Portfolio: Spread your investments across different asset classes to reduce risk and increase the chances of beating inflation.

- Consider Real Assets: Investments in real assets like real estate or commodities often fare well during inflationary periods.

- Think Long-Term: Long-term investments in stocks or mutual funds can provide returns that outpace inflation over time.

The Importance of Emergency Funds in Times of Inflation

Having an emergency fund is always wise, but it becomes even more critical during inflationary times for several reasons:

- Unexpected Expenses: An emergency fund can cover unexpected expenses without derailing your budget.

- Financial Flexibility: It provides financial flexibility, allowing you to avoid high-interest debt during challenging times.

- Peace of Mind: Knowing you have a financial cushion can reduce stress and make it easier to cope with rising prices.

Financial Planning Strategies for Long-Term Inflation Adaptation

Long-term financial planning is essential for adapting to inflation:

- Regularly Review and Adjust Your Budget: As inflation changes, so should your budget. Regular reviews can help you stay on track.

- Increase Your Income: Consider ways to increase your income through side gigs, asking for a raise, or upgrading your skills.

- Plan for Higher Retirement Costs: Factor in higher future costs when planning for retirement to ensure your savings will suffice.

The Psychological Impacts of Inflation on Spending and Saving Habits

Inflation can significantly affect our psychology and behavior regarding spending and saving:

- Increased Anxiety: Concerns over rising prices and eroding purchasing power can lead to financial stress and anxiety.

- Spending vs. Saving: The decision to spend now rather than save for later can be influenced by inflation, as money will likely be worth less in the future.

- Risk Tolerance: Inflation can change one’s risk tolerance, with some choosing to invest more aggressively to outpace inflation.

Global Inflation Trends and Their Implications for Your Finances

Global inflation trends can have localized impacts, influencing everything from the cost of imported goods to foreign investment returns:

- Imported Inflation: Countries with significant imports can experience inflation due to rising costs abroad.

- Currency Depreciation: High inflation can lead to currency depreciation, affecting international purchasing power and investments.

- Global Investment Strategies: Understanding how inflation impacts various markets can guide better investment decisions internationally.

Conclusion: Staying Financially Resilient in an Inflationary World

Navigating an inflationary environment requires awareness, flexibility, and proactive financial planning. By understanding the impacts of inflation and employing strategies to mitigate these effects, individuals can maintain, and even improve, their financial well-being despite economic fluctuations. Investing wisely, maintaining a solid emergency fund, and adapting budgeting practices are all part of a holistic approach to financial resilience. Furthermore, considering global inflation trends and their implications for personal finance is becoming increasingly important in our interconnected world.

The key to financial resilience lies in preparedness and adaptability. As inflationary trends evolve, so too should our strategies for managing our finances. Embracing a mindset of continuous learning and adjustment can empower individuals to navigate the complexities of inflation successfully.

Ultimately, the goal is not just to survive in an inflationary environment but to thrive. With the right knowledge and tools at your disposal, you can protect and grow your wealth, ensuring financial stability for you and your family for years to come.

Recap

- Inflation affects everyday expenses and savings, making it crucial to adapt your budgeting and financial planning strategies.

- Investing in a diversified portfolio and real assets can help outpace inflation.

- An emergency fund is invaluable in times of inflation, providing financial flexibility and peace of mind.

- Psychological impacts of inflation include increased anxiety and changes in spending and saving habits, highlighting the need for smart financial decisions.

- Global inflation trends necessitate a broader view of personal finance, incorporating international considerations into financial planning.

FAQ

1. What is inflation?

Inflation is the rate at which the general price level of goods and services is rising, leading to a decrease in purchasing power.

2. How does inflation affect my household budget?

Inflation increases the cost of living, reduces the ability to save, and can delay financial goals by decreasing your money’s value.

3. Can investing protect me against inflation?

Yes, investing in a diversified portfolio, especially in assets historically outpacing inflation, can protect and grow your wealth.

4. What is the link between inflation and interest rates?

Interest rates are often adjusted to control inflation. High inflation can lead to higher interest rates and vice versa.

5. Why is an emergency fund important during inflation?

An emergency fund provides financial flexibility and security, helping you manage unexpected expenses without impacting your budget significantly.

6. How can I adapt my finances to cope with inflation?

Adapt by budgeting wisely, increasing income, investing intelligently, and planning for higher future costs.

7. What psychological effects can inflation have?

Inflation can increase stress and anxiety about finances, influence spending vs. saving decisions, and alter risk tolerance.

8. How do global inflation trends affect my finances?

Global inflation can impact the cost of imports, currency value, and investment returns, affecting overall financial planning.

References

- Bureau of Labor Statistics. (n.d.). Consumer Price Index. https://www.bls.gov/cpi/

- Federal Reserve History. (n.d.). What is Inflation? https://www.federalreservehistory.org/essays/inflation

- Investopedia. (n.d.). How Inflation Eats Away at Your Savings. https://www.investopedia.com/articles/personal-finance/030915/how-inflation-eats-away-your-savings.asp