How to Manage Financial Stress During Major Life Transitions

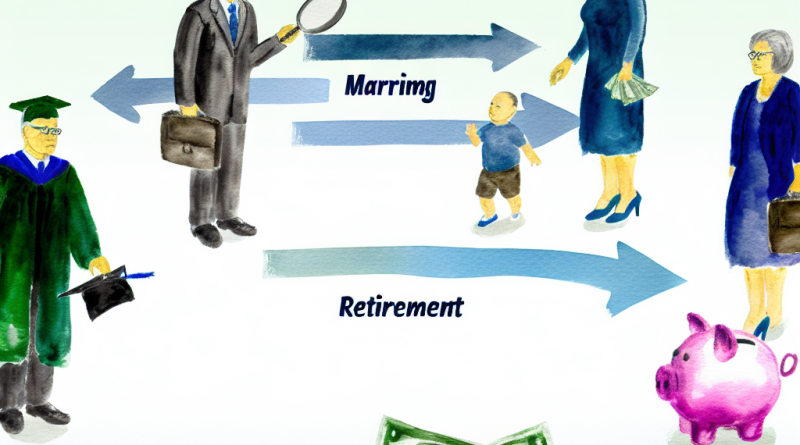

Financial stress is an omnipresent challenge in our modern world, magnified during significant life transitions. These pivotal moments, whether joyful or sorrowful, often bring with them fluctuations in financial stability. Understanding the nature of financial stress and how it correlates with major life events is crucial for effective money management and ensuring a smooth transition.

During life’s major events—such as marriage, having a child, or changing careers—financial demands can escalate rapidly. These transitions necessitate a reevaluation of financial strategies, often leading to heightened stress levels. Many people find themselves unprepared for these changes, lacking the financial planning needed to handle new responsibilities.

Recognizing financial stress during these times is vital. Common symptoms can manifest both physically and emotionally, affecting overall well-being. Developing strategies to manage financial stress can reduce its negative impact, enabling individuals to focus more on enjoying life changes rather than being overwhelmed by them.

One of the most effective ways to cope with financial stress during life transitions is to adopt comprehensive stress management techniques. These include creating practical financial plans, establishing emergency funds, and utilizing financial tools and apps. With the right approach, it is possible to navigate life transitions with confidence and less anxiety.

Common Major Life Transitions Impacting Finances

Life is full of pivotal moments that can alter the trajectory of one’s financial situation. Several transitions are particularly significant for their potential to impact personal finances.

Marriage or Partnership

Entering into a marriage or long-term partnership is often accompanied by complex financial considerations. Couples must navigate joint expenses, shared financial goals, and the merging of assets and debts. A lack of clear communication can lead to misunderstandings, making it essential to establish common financial objectives and create a joint budget.

Parenthood

Becoming a parent drastically changes one’s financial obligations. From prenatal care to college tuition, the financial implications are substantial and long-lasting. Planning for these expenses requires a proactive approach, including saving for education and considering insurance to safeguard the family’s future.

Career Changes

Whether it’s a promotion, career shift, or job loss, professional changes directly impact income and financial capacity. Understanding the financial implications of a career change upfront can help prepare for potential periods of reduced income or increased job-related expenses, such as commuting costs or professional development.

Recognizing Symptoms of Financial Stress

Financial stress can manifest in various ways, affecting mental health and daily functioning. Recognizing these symptoms early can lead to more effective management strategies.

Physical Symptoms

Physical signs of financial stress can include frequent headaches, sleep disturbances, and changes in appetite. Chronic stress might also lead to more severe health issues like hypertension or heart disease. It’s essential to not disregard these indicators as they can worsen over time.

Emotional and Behavioral Symptoms

Emotionally, individuals may experience anxiety, depression, or irritability. Financial stress can also lead to behaviors such as excessive gambling or substance abuse as means of coping. These symptoms can be detrimental, both personally and in relationships.

Financial Warning Signs

Missing bill payments, relying on credit for essential purchases, or feeling consistently overwhelmed by financial obligations are clear indicators of financial stress. Monitoring these financial patterns can help in taking actionable steps toward improvement.

Creating a Practical Financial Plan

A solid financial plan can alleviate financial stress during major life transitions. It involves prioritizing expenses and aligning them with financial goals.

Setting Clear Goals

Defining what you want to achieve financially, whether it’s buying a home or saving for retirement, provides direction. Clear goals make it easier to allocate resources effectively and stay motivated.

Assessing Your Current Financial Situation

Take stock of your income, expenses, debts, and assets. This assessment is crucial for formulating a personalized financial strategy that reflects your circumstances.

Developing and Maintaining a Plan

A financial plan is not static; it should evolve over time. Regularly review and adjust your plan in response to changes in income, expenses, or life circumstances. Financial planning is an ongoing process that benefits from continual refinement.

Establishing an Emergency Fund

An emergency fund acts as a financial safety net, providing peace of mind in times of unexpected costs or income disruptions.

Understanding the Need for an Emergency Fund

Unexpected events, such as medical emergencies or job loss, can strain finances without warning. An emergency fund can cover these unanticipated expenses, preventing the need to dip into savings meant for other goals.

How Much to Save

Financial experts often recommend saving three to six months’ worth of living expenses. The exact amount depends on your particular circumstances, such as job stability and income level.

| Recommended Savings | Months of Expenses Covered | Rationale |

|---|---|---|

| 3 Months | Basic buffer | Ideal for stable incomes |

| 6 Months | More comprehensive | Suitable for less predictable income or single-income households |

Building a Fund Gradually

Start small by setting aside a manageable amount each month. Automatic transfers to a dedicated savings account can ensure consistency. Over time, your fund will grow, providing a sense of security.

Budgeting for Life Transitions

Effective budgeting is at the core of managing finances during major life events. It requires an adaptive approach to ensure financial stability.

Tailoring Your Budget to Your New Situation

A significant life change often necessitates a reevaluation of spending habits. Compare your income against necessary expenses and adjust discretionary spending accordingly. This might involve temporary lifestyle adjustments to accommodate new financial realities.

Utilizing Budgeting Tools and Resources

Numerous tools are available to help manage your budget more efficiently. From spreadsheets to budgeting apps, these resources can simplify tracking income and expenses and help identify areas for improvement.

Regular Assessment and Adjustment

Continuously monitor your budget to ensure it remains aligned with your financial goals and life circumstances. Regular assessments can help identify trends or areas needing attention, allowing for timely adjustments.

Seeking Professional Financial Advice

Professional advisors can provide invaluable guidance during financial transitions, helping to navigate complex situations.

Identifying When to Seek Help

If you’re uncertain about how to handle your finances during a life transition, or if stress becomes overwhelming, seeking advice from a certified financial planner can be beneficial. They can offer personalized advice tailored to your specific needs.

Choosing the Right Financial Advisor

Look for advisors with the appropriate credentials and a good track record. Understand their fee structure—whether it’s a flat fee, commission, or another model. Personal recommendations or online reviews can assist in making the right choice.

Benefits of Professional Advice

Professional advice offers perspective and strategies you might not have considered. An advisor can help with tax planning, investment strategies, and retirement planning, providing peace of mind and potentially saving money.

Practicing Mindfulness and Stress Reduction Techniques

Managing stress effectively can improve overall well-being and financial decision-making. Mindfulness and other techniques can mitigate the impact of financial stress.

Understanding Mindfulness

Mindfulness involves staying present and aware of your thoughts and feelings without judgment. This practice can reduce anxiety and improve focus, leading to better decision-making.

Stress Reduction Techniques

Incorporate regular exercise, deep breathing exercises, or yoga into your routine. These activities reduce cortisol levels, fostering a calmer state of mind.

Balancing Mind and Finances

A calm, balanced mindset can result in more rational financial decisions. Taking time to clear your head before making financial choices ensures more thoughtful and less impulsive planning.

Leveraging Financial Tools and Apps

Modern technology offers a range of tools that can assist in managing finances more effectively during transitions.

Popular Financial Apps

Applications like Mint, YNAB (You Need A Budget), and PocketGuard provide easy ways to track expenses, set budgets, and visualize financial goals. These tools can automate tracking and help eliminate human error.

Benefits of Digital Financial Management

Using apps not only streamlines financial tracking but also brings awareness to spending habits. Real-time notifications and analytics can assist in making more informed choices.

Comparison and Selection

Evaluate the features of various tools based on your specific needs. Consider compatibility with your devices and the security measures they employ to protect your financial information.

Building a Support Network

A robust support network can provide emotional and practical assistance during financial stress.

Importance of a Support System

Friends, family, or community groups can offer guidance and encouragement, reducing feelings of isolation. Sharing experiences with others in similar situations can provide comfort and new perspectives.

Engaging with Support Groups

Participate in financial literacy workshops or community groups focused on personal finance. These settings provide opportunities to learn and share strategies in a supportive environment.

Open Communication

Cultivate honest conversations about finances within your network. Transparency can lead to constructive feedback and collaborative problem-solving.

Conclusion and Long-term Financial Well-being

Navigating financial stress during life transitions is challenging but manageable with the right tools and mindset. By understanding financial stress and proactively addressing it through strategic planning and support, you can ease the burden of major life changes.

Long-term financial well-being relies on consistent planning, adaptability, and informed decision-making. Recognizing that life transitions can bring opportunities as well as challenges is crucial for maintaining financial health.

By embracing changes and proactively managing finances, individuals can not only survive but thrive during life’s major transitions, laying the groundwork for a stable and fulfilling financial future.

Recap

- Financial stress is common during major life transitions, such as marriage, parenthood, and career changes.

- Recognizing symptoms of financial stress can prevent long-term issues.

- Creating a practical financial plan and establishing an emergency fund are crucial steps.

- Using budgeting tools and seeking professional advice can provide guidance during uncertainties.

- Mindfulness and a strong support network can aid in managing stress effectively.

FAQ

1. What are common symptoms of financial stress?

Common symptoms include anxiety, depression, headaches, sleep disturbances, and changes in appetite.

2. How much should I save in an emergency fund?

Aim to save three to six months’ worth of living expenses, tailored to your financial situation and job stability.

3. When should I seek professional financial advice?

Consider consulting a financial advisor if you’re facing complex financial decisions or overwhelming stress during life transitions.

4. How can mindfulness help with financial stress?

Mindfulness encourages present-moment awareness, which can reduce anxiety and improve decision-making regarding finances.

5. What are some recommended financial management apps?

Popular apps include Mint, YNAB, and PocketGuard for tracking expenses and budgets.

6. Why is a support network important during financial stress?

A support network offers emotional and practical assistance, reducing feelings of isolation and providing new insights.

7. How can I adjust my budget for life transitions?

Tailor your budget to reflect new income and expenses, using tools and resources to track changes and adjust accordingly.

8. What are the benefits of digital financial tools?

Digital tools provide real-time tracking, analytics, and notifications, helping you make informed financial decisions.

References

- How Financial Planning Ensures Stability During Major Life Changes

- Investopedia – Personal Finance Basics

- CFP Board – Financial Planning Resources