How to Create a Budget That Truly Reflects Your Personal Values

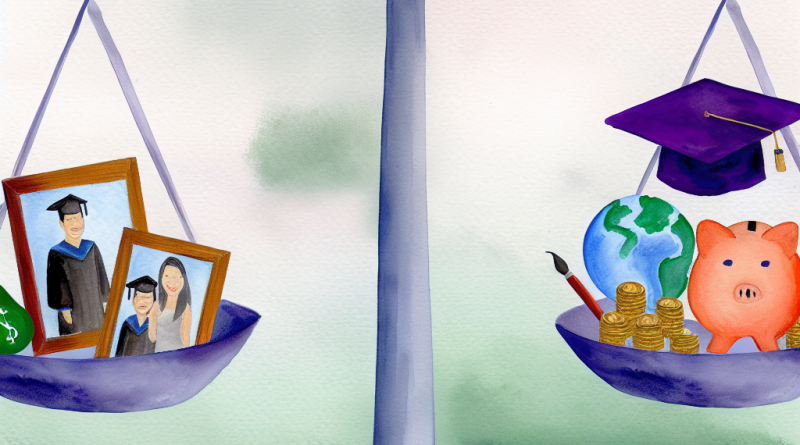

Understanding and managing personal finance is a journey that can often feel overwhelming. For many, creating a budget is the first step towards achieving financial stability. However, the traditional approach to budgeting can sometimes feel restrictive or out of touch with your personal aspirations and values. What if, instead of just tracking numbers, your budget could reflect your core beliefs and what you genuinely care about in life? This is where values-based budgeting comes into play—a method that aligns your financial resources with your personal values.

Values-based budgeting is a powerful approach that can transform the way you perceive and handle your finances. By focusing on what truly matters to you, this type of budgeting encourages mindful spending and intentional saving. It’s not just about crunching numbers; it’s about ensuring that your financial activities are meaningful and purpose-driven. This process not only helps to manage your finances more effectively but also contributes to a more fulfilling and balanced lifestyle.

At its core, values-based budgeting requires you to thoughtfully consider what you value most in life. These may include relationships, personal growth, health, or adventures. Once identified, these values can guide your financial decisions, ensuring that your spending and saving habits support your ideals and contribute to your overall happiness. This approach is transformative because it helps bridge the gap between your monetary actions and your life goals.

Creating a budget that reflects your personal values involves several steps. It begins with identifying your core values, understanding your current financial situation, and setting financial goals that match your values. From there, it involves continuously tracking expenses, creating a tailored budget plan, and adjusting your budget as life changes. In this article, we will delve into these elements along with some practical tips to help you embark on the rewarding journey of values-based budgeting.

Understanding the Importance of Values-Based Budgeting

Values-based budgeting isn’t just another financial trend; it’s a substantive approach that interlinks personal finance with individual beliefs and priorities. At its essence, this type of budgeting is about choosing where your money goes based on your true values rather than external or societal pressures. This intentionality is crucial in creating meaning and satisfaction in how finances are managed.

One significant advantage of values-based budgeting is its ability to reduce financial stress. When spending and saving align with personal values, individuals often feel a stronger sense of control over their financial situation. This alignment can lessen the anxiety surrounding financial decisions because each choice is a reflection of broader life goals and significance.

Moreover, a values-based approach to budgeting can foster long-term financial health and personal development. By concentrating on true priorities, individuals often find they are subject to less impulse buying and more thoughtful financial planning. As a result, savings grow, debt dwindles, and financial challenges become more manageable over time.

Identifying Your Core Personal Values

Identifying your core personal values is a foundational step in values-based budgeting. This process calls for introspection and honesty with oneself. What makes you genuinely happy? What do you want to achieve in life? These questions require reflection and often lead to powerful insights.

Begin by listing down activities or causes that resonate with you deeply. Do you value family time over professional growth? Is community service important, or does personal freedom take precedence? These priorities will form the cornerstone of your budgeting strategy.

Additionally, several tools can aid in recognizing these values. Journaling can be an effective method, as it allows you to note recurring themes and emotions linked to various activities. Various online quizzes and introspective exercises also exist to clarify personal values, providing a structured way to uncover what’s most important to you.

Assessing Your Current Financial Situation

Before restructuring your budget around your values, it’s essential to understand your current financial situation. This involves a thorough assessment of income, expenditures, debts, and savings. Seeing this landscape in its entirety aids in pinpointing areas that need adjustment.

To start, track all your income sources, including salary, bonuses, and any other forms of earnings. Next, list your monthly expenses, which can be fixed (like rent/mortgage and utility bills) and variable (such as groceries, entertainment, and dining out). Also, take note of any debts, paying particular attention to interest rates and repayment timelines.

Exploring this segment often reveals expenses that contradict your values. For instance, you might find excessive spending on luxury items that do not align with your goal of saving for travel or education. Understanding these discrepancies provides a roadmap for realignment.

| Assessing Debt | Evaluating Savings |

|---|---|

| Identify all debts, including credit, student loans, etc. | Calculate total savings and emergency fund |

| Prioritize high-interest debts first | Define short-term and long-term financial goals |

| Regular review with credit score checks | Consider investments for extra income |

Setting Financial Goals Aligned with Your Values

Once personal values are identified, it’s time to establish financial goals aligned with those values. These goals will serve as checkpoints and motivation along your financial journey. They can be short-term, such as saving for a new hobby, or long-term, like planning for early retirement.

To create meaningful goals, categorize them based on importance and the timeframe required to achieve them. A goal-setting framework like SMART (Specific, Measurable, Achievable, Relevant, Time-bound) can be particularly helpful in this process.

For example, if health and wellness are core values, a corresponding financial goal might be to allocate 10% of your monthly budget to organic food and fitness classes. For those valuing education, saving for courses or books might take precedence.

Tracking Expenses to Identify Spending Patterns

Monitoring your expenses allows you to identify spending patterns. This awareness is key to crafting a budget that supports your values rather than undermines them. Children’s education, travel, or hobbies—every spending decision should ultimately contribute positively to your values.

Start by using financial tracking methods—manual record-keeping, spreadsheets, or budgeting apps—to capture all transactions. At the end of each month, review these transactions to spot trends or patterns that either align or conflict with your desired values.

This practice of regular review can highlight unnecessary expenditures, empower you with information to curtail wasteful spending, and increase investment in things truly meaningful to you.

Creating a Customized Budget Plan

After understanding your financial situation and spending patterns, the next step involves crafting a personalized budget that mirrors your values. Unlike traditional budgets, there is no one-size-fits-all; this budget should be unique to your personal lifestyle and aspirations.

Start with a foundation of essential expenses that every budget needs: housing, utilities, insurance, etc. From there, integrate categories that reflect your values—whether it’s education, travel, philanthropy, or luxury. Each category should have a realistic monetary cap.

Creating a table can be especially useful in laying out your budget format, which aids in visualizing how funds are distributed and ensuring that each value holds significance within the overall plan.

| Budget Category | Allocated Amount |

|---|---|

| Essentials | 50% of income |

| Savings/Investments | 20% of income |

| Value-based Goals | 20% of income |

| Discretionary Expenses | 10% of income |

Implementing the Budget Daily

Even the best-laid budget plans can falter without daily implementation. Living within your budget involves more than just observing it once a month; it’s about integrating it into your daily decisions and adjusting your mindset to view the budget as an essential, life-altering tool.

Keep your values and budgeting goals at the forefront of everyday financial decisions. Develop small habits that cumulatively foster adherence, such as planning your purchases, resisting impulse buys, and routinely reviewing your budget against actual spending.

Nurturing this discipline ensures consistency, and over time, these repetitive actions will solidify into beneficial habits, making the budget an integral part of your lifestyle.

Adjusting Your Budget as Life Changes

Life is unpredictable, and circumstances can shift quickly, necessitating adjustments in your budget. Whether it’s a career change, family expansion, or moving to a new city, your budget should be flexible enough to adapt to life’s ebbs and flows.

When changes occur, revisit your budget to reallocate funds in response to new priorities or hurdles. Ongoing review and modification accommodate life’s unpredictability, ensuring that your budgeting remains effective and relevant.

Remember, a fluid budget encourages resilience and adaptability without compromising the values-based integrity underpinning your fiscal strategy.

Using Tools and Apps to Simplify Budget Management

In today’s digital age, various tools and apps can significantly simplify budget management. These technological aides provide convenience and efficiency, automating parts of the budgeting process that can be monotonous and time-consuming.

Apps can streamline tracking, offering real-time insights and analytics on your financial behavior. They can facilitate goal-setting with alerts and reminders, embed savings plans directly linked to bank accounts, and even offer community forums for shared experiences and advice.

Selecting the right app depends greatly on your personal preferences, but some renowned names include YNAB (You Need A Budget), Mint, and PocketGuard, each offering unique features catered to support values-based financial management.

Building a Support System for Budget Accountability

Creating a support system around your budgeting efforts can increase accountability and keep you motivated. This system might consist of family members, financial advisors, or close friends who understand your financial goals and values.

Having someone to share progress with, discuss challenges, and receive encouragement can play a critical role in maintaining your commitment to a values-based budget. Consider forming or joining a financial wellness group where members can discuss successes, share setbacks, and provide mutual support and accountability.

Additionally, involving a partner or family member in your budgeting journey ensures that everyone is on board with the values-based financial plan, creating a cohesive household approach to money management.

Reflecting on the Success of Your Value-Based Budget

Reflection is key to assessing the effectiveness of your budget. Regularly reviewing your financial progress helps gauge whether your budgeting plan is truly capturing your values and facilitating the achievement of your financial goals.

Keep a journal to record your reflections, noting occasions when your budgeting brought contentment and times it may have fallen short of expectations. This reflective practice lends itself to conscious adjustments to your plans, ensuring ongoing growth and satisfaction.

As you reflect, celebrate your victories, however small. Value-based budgeting is an evolving journey, and recognizing progress reinforces positive behaviors, encouraging continued dedication to this meaningful financial approach.

Conclusion

Creating a budget that truly reflects your personal values is a deeply enriching endeavor. As financial planning becomes increasingly centered around personal values, individuals can embrace a sense of peace and fulfillment that extends beyond monetary wealth. Recognizing and aligning your expenditures with what you genuinely cherish reinvests significance into every financial decision you make.

Values-based budgeting isn’t a one-time effort; it demands constant reflection and reevaluation, requiring flexibility and adaptability to life’s changes. However, with dedication and persistence, this approach ensures that your financial habits are not merely productive, but also inherently meaningful and in harmony with your life’s purpose.

Ultimately, values-based budgeting turns a financial plan into a life plan, connecting dollars and cents with mission and meaning. By forging such connections, you not only foster fiscal discipline but also build a life steeped in purpose and intent.

Recap

Here’s a recap of the main points discussed in this article:

- Values-based budgeting aligns your financial decisions with your core personal values.

- Start by identifying your core values and assessing your current financial situation.

- Set financial goals that are aligned with these values and consistently track your expenses.

- Create a customized budget plan, implement it daily, and adjust as your life changes.

- Leverage tools and apps, build a support system, and regularly reflect on your budgeting journey.

FAQ

1. What is values-based budgeting?

Values-based budgeting is a financial approach that aligns your spending and saving habits with your personal values, ensuring that your financial activities support your life goals and aspirations.

2. How do I start creating a values-based budget?

Start by identifying your core values, assessing your financial situation, and setting goals that align with these values. Then, design a budget plan that reflects these priorities.

3. What tools can help with budgeting?

Apps like YNAB, Mint, and PocketGuard can simplify budget management by automating expense tracking and providing tools for goal-setting and financial analytics.

4. How often should I review my budget?

Regular reviews are essential. Monthly assessments are recommended to ensure your budget aligns with your financial goals and adapts to any life changes.

5. Can a value-based budget change over time?

Yes, as your life circumstances and personal values evolve, your budget should adapt accordingly to remain effective and relevant.

6. What if my income changes suddenly?

In the event of income changes, revisit your budget to reallocate funds and adjust your financial goals to address your new financial reality.

7. How do I deal with financial setbacks during budgeting?

Reflect on the setback, adjust your budget as necessary, and use support systems such as family or budgeting communities for guidance and encouragement.

8. Why is a support system important in budgeting?

A support system offers accountability, motivation, and guidance, making it easier to stay committed to your budgeting goals.

References

- Chapman-Clarke, Margaret. Values-Based Financial Planning. HarperCollins, 2021.

- Harris, Ken. Your Money or Your Life: The Empowering Path to Financial Freedom. Penguin Books, 2022.

- Smith, Lauren. The Mindful Budget: Finding Personal Fulfillment in Financial Planning. McGraw-Hill, 2020.